97

14323

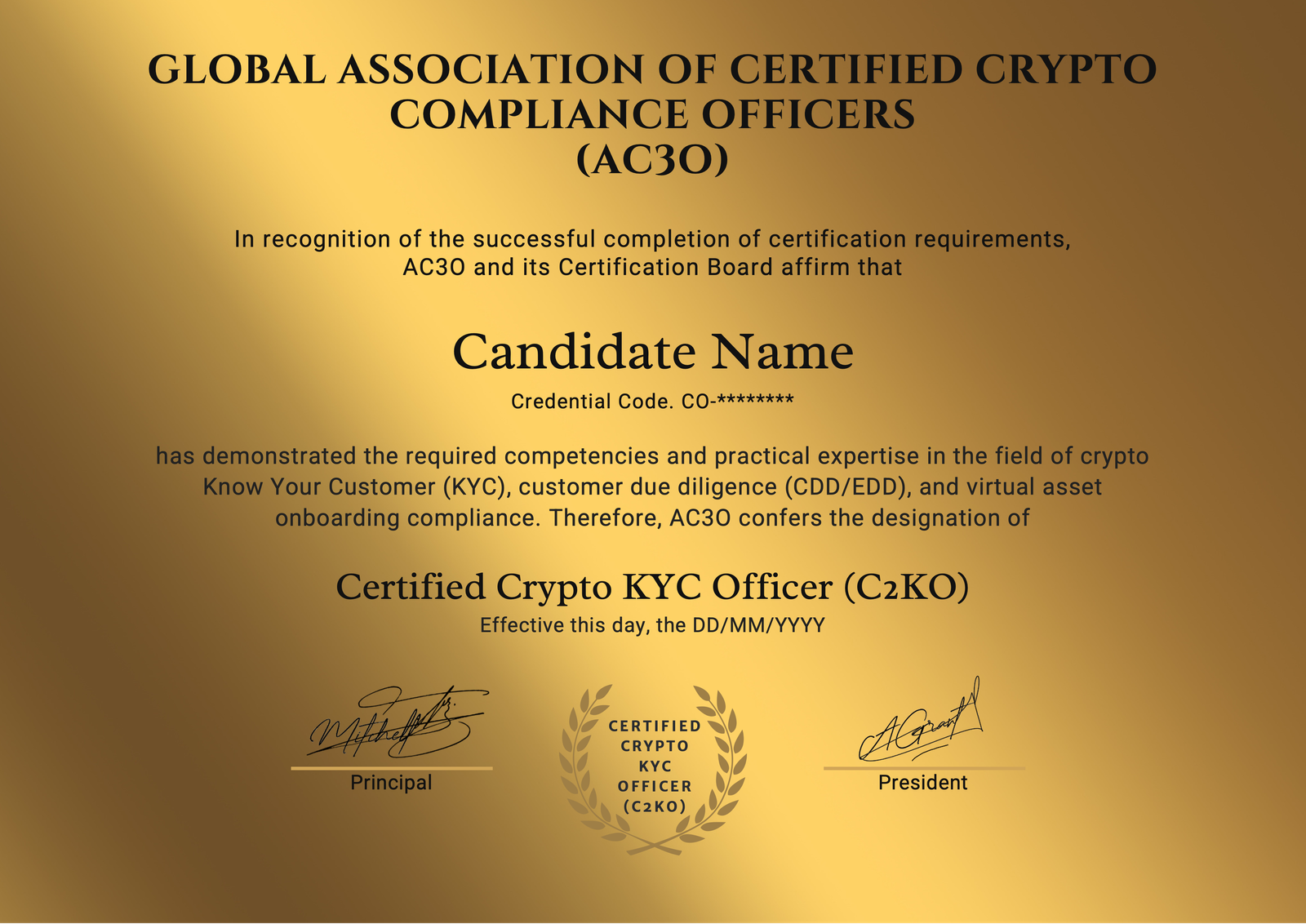

The C2KO – Certified Crypto KYC Officer is a globally recognized crypto KYC certification trusted by VASPs, regulators, and financial institutions in 180+ countries. This program focuses on end-to-end KYC, CDD/EDD, and RegTech-driven onboarding practices, preparing you to meet the latest FATF and VASP compliance standards with confidence.

The C2KO – Certified Crypto KYC Officer™ is a globally recognized KYC certification program designed for KYC, CDD, and onboarding professionals working with virtual asset service providers (VASPs), crypto exchanges, and fintech institutions.

This program provides comprehensive, hands-on training on performing customer due diligence, enhanced due diligence, and identity verification within the fast-evolving digital asset ecosystem.

Accreditation

✅ Accredited by ONRIGA

✅ Blockchain-verified certificate

✅ Globally Recognized and Accepted in 180+ Countries

What You Will Learn

- Implement KYC/CDD frameworks tailored for VASPs and crypto institutions

- Verify customer and entity identities using on-chain and off-chain data

- Detect fraudulent identities, stolen credentials, and fake exchanges

- Apply FATF and MiCA-aligned onboarding and screening requirements

- Design customer risk assessment and ongoing monitoring workflows

- Leverage RegTech and automation tools for scalable KYC programs

Course Modules

Module 1 – Foundations of KYC in the Crypto Ecosystem

- Why KYC in crypto differs from traditional banking models

- Role of KYC within AML and CFT frameworks for VASPs

- Practical application of FATF Recommendation 10 for crypto businesses

- VASP licensing expectations and regulatory review focus areas

- KYC challenges in decentralized and semi-decentralized environments

- Common identity failures in crypto onboarding

- Case study on identity gaps leading to exchange penalties

- Practitioner perspective on how crypto KYC changes daily operations

Module 2 – Customer Identification and Verification (CIV)

- Individual customer identification in crypto environments

- Corporate and institutional customer identification

- Verifying wallet ownership and use of digital signatures

- Understanding wallet types and associated risk implications

- Ultimate Beneficial Ownership (UBO) in crypto-linked entities

- Beneficial ownership transparency challenges in layered structures

- Documentation standards under FATF and MiCA

- Case study on KYC breakdowns and identity-driven fraud patterns

- Practitioner guidance on acceptable versus unacceptable evidence

Module 3 – Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

- Risk-based CDD for crypto customers

- Designing CDD workflows for individuals versus corporates

- Triggering EDD and escalation decision logic

- EDD for PEPs, sanctions exposure, and high-risk jurisdictions

- Source of funds and source of wealth assessment in crypto contexts

- Ongoing due diligence and periodic review cycles

- Building practical CDD and EDD risk scoring models

- Onboarding risk assessment templates and documentation standards

- Practitioner decision framework for CDD versus EDD

Module 4 – Screening, Risk Scoring, and Monitoring Tools

- Name screening for sanctions, PEPs, and adverse media

- Wallet screening and blockchain risk indicators

- Understanding limitations of KYT, KYC, and RegTech tools

- Integrating multiple data feeds without creating risk blind spots

- Identifying red flags in crypto customer behavior

- Escalation, review, and documentation best practices

- Continuous monitoring of customer and transaction behavior

- Case study on analytics-driven detection of mule accounts

- Practitioner judgment versus automated tool outputs

Module 5 – Regulatory Compliance and Data Management

- Record-keeping obligations for crypto KYC

- Data retention expectations under FATF and MiCA

- Data protection, privacy, and GDPR implications for KYC

- Managing cross-border KYC data and verification vendors

- Oversight and accountability of third-party verification providers

- Audit trails and evidence preservation

- Internal controls for KYC operations

- Coordination between KYC, AML, and fraud teams

- Preparing audit-ready KYC files

Module 6 – Governance, Audits, and Global Enforcement Trends

- KYC governance structures in crypto organizations

- Roles and responsibilities of KYC Officers, MLROs, and Compliance Heads

- Internal KYC audits and control testing

- Regulatory reviews and inspection readiness

- Global enforcement trends affecting crypto KYC

- Lessons from exchange and VASP enforcement actions

- ONRIGA-compliant KYC audit checklist

- Building a sustainable culture of compliance

- Practitioner expectations during regulatory scrutiny

Exam & Certification Details

Format: 100 MCQs

Duration: 90 minutes

Passing Score: 75%

Attempts: 2 included

Validity: 2 years (Renewal 20% fee)

Course Currilcum

-

- C2KO Official Study eBook Unlimited

-

- C2KO Final Certification Exam 01:30:00

Course Reviews

4.6

- 5 stars66

- 4 stars25

- 3 stars6

- 2 stars0

- 1 stars0

The C2KO exam was challenging but fair. I liked that it tested real understanding instead of memorization.

A must for crypto compliance professionals. The CDD templates alone justify the enrollment cost.

C2KO taught me how to properly perform EDD on high-risk customers. The real-world crypto examples are spot on.